Is pairs trading too good to be true in 2025?

Pair Trading, NSE F&O, Options Trading, Indian Stock Market, Market neutral strategy, statistical arbitrage

Pairs Trading in 2025: Is It Too Good to Be True?

A Transparent Guide to Cointegration, Success Rates, and Market-Neutral Opportunities in the Indian Stock Market

Published: December 25, 2025 | By QuantPairTradingIndia.co.in

Pairs trading, a powerful market-neutral statistical arbitrage strategy, often seems too good to be true: profit from relative movements between two correlated stocks, regardless of overall market direction. But in 2025, with evolving markets and increased competition, is it still effective—especially for Indian traders on the NSE?

At QuantPairTradingIndia.co.in, we focus on cointegration-based pairs trading using a robust algorithm that identifies truly mean-reverting pairs. In this post, we'll provide transparent insights backed by research, explain our methodology, and discuss realistic possibilities for Indian traders.

What Is Pairs Trading and Why Cointegration Matters

Pairs trading involves trading two historically related stocks (e.g., HDFC Bank & ICICI Bank) by going long on the undervalued one and short on the overvalued when their spread diverges, profiting on convergence.

While simple correlation is often used, it can break down. Cointegration is superior—it identifies pairs with a stable long-term equilibrium, making mean-reversion more reliable.

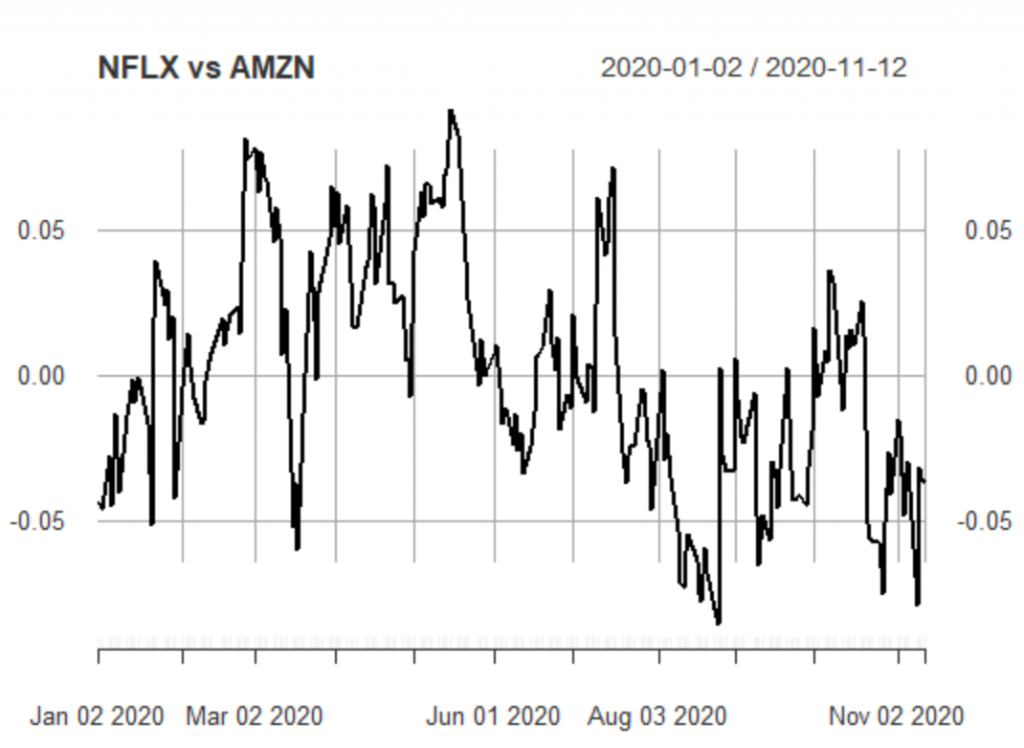

Here's a classic spread convergence illustration:

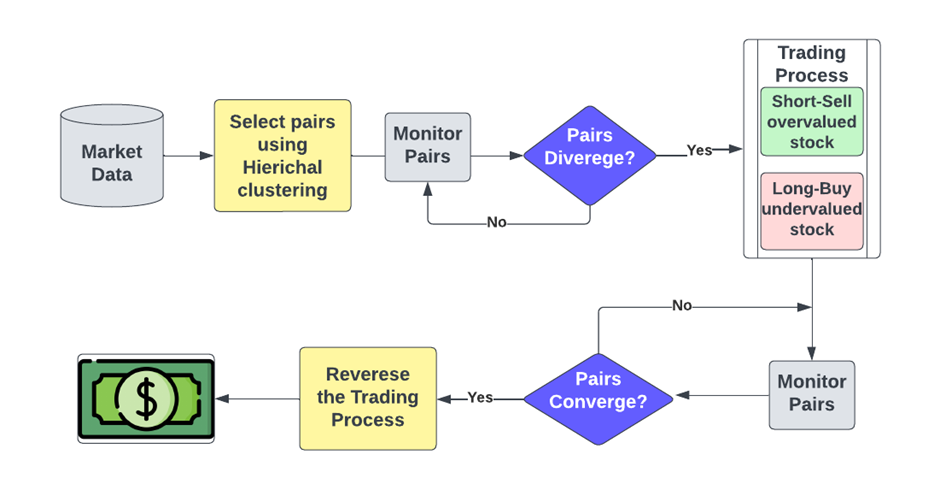

QuantPairTradingIndia's Algorithm: Step-by-Step Transparency

Our approach at QuantPairTradingIndia.co.in emphasizes cointegration over mere correlation for better reliability:

- Data Collection: Fetch historical closing prices (e.g., last 200 days) for NSE stocks.

- OLS Regression: Fit a linear model to find the hedge ratio.

- ADF Test on Residuals: Confirm cointegration if residuals are stationary (strong mean-reversion signal).

- Z-Score Calculation: Generate trade signals when the spread deviates significantly (e.g., ±2 standard deviations).

This methodology, detailed on our site, has shown promising results in backtests and live tracking for Indian F&O pairs like banking and IT sector stocks.

Research and Success Rates in 2025

Studies confirm pairs trading profitability, though returns have moderated:

- Classic 2006 research: ~11% annualized returns historically.

- Recent analyses (2024-2025): Cointegration strategies deliver 8-15% realistic annualized returns after costs, with 60-80% win rates in optimized setups.

- In India: NSE sectoral pairs (e.g., banks, IT) show strong potential due to occasional inefficiencies.

Non-convergence and costs are key risks, but disciplined cointegration-based execution improves odds.

Pairs Trading in India: Opportunities and Practice

Indian markets are ideal for pairs trading via F&O, with popular co-integrated pairs in banking (HDFC-ICICI), IT (TCS-Infosys), and indices (Nifty-Bank Nifty).

Professional quants and growing retail traders use it, often with options to avoid MTM issues (e.g., debit spreads or synthetic positions).

Benefits, Risks, and Realistic Expectations

Benefits: Market-neutral, lower volatility, statistical edge in volatile Indian markets.

Risks: Divergence without convergence, transaction costs, need for precise tools.

Explore More at QuantPairTradingIndia.co.in

Visit QuantPairTradingIndia.co.in for in-depth guides on our cointegration algorithm, top NSE pairs watchlists, options-based strategies, performance updates, and educational resources to help you implement pairs trading effectively.

Start your pairs trading journey today! Visit QuantPairTradingIndia.co.in for free resources, pair suggestions, and algorithm insights.

We're building a community-focused site with transparent strategies—perfect for Indian traders seeking consistent, low-risk opportunities.

Final Thoughts

Pairs trading isn't magic, but with cointegration and discipline, it's a proven market-neutral strategy